Hi everyone. I’m Stephanie LI.

Coming up on today’s program

Here’s what you need to know about China in the past 24 hours

China said on Thursday it would expand a private pension scheme nationwide from December 15, following a pilot effort, as it moves to plug a pension gap in plans to help a rapidly aging population.

Those covered by public pension insurance will be allowed to open private pension accounts and invest up to 12,000 yuan a year in financial products, five official bodies, including the human resources ministry, said in a joint notice.

The scheme expands the category of eligible pension products by including government bonds, designated pension savings and index funds, they added.

According to the latest directory of individual pension funds released by the China Securities Regulatory Commission, as of today, there are 284 pension funds products, with 85 index funds run by 30 institutions being recently added.

The new provisions have also introduced rules to allow earlier withdrawals under specified conditions, including permanent disability, severe illness, unemployment, and having moved abroad.

More than 60 million people have opened personal pension accounts since the introduction of China's private pension system in late 2022, data from the Ministry of Human Resources and Social Security showed.

Private pensions are a part of the “third pillar” of China's pensions system to supplement the public safety net and corporate annuities.

With approximately 217 million people aged 65 and above, China is home to the world's largest elderly population, and roughly one in every four seniors globally.

A society is considered "aged" when those aged 65 and above account for 14 percent of the total population, and "super-aged" when the proportion exceeds 20 percent, according to the WHO. The figure stood at 15.4 percent in China in 2023.

The China Research Center on Aging predicts that the silver economy could grow from its current value of 7 trillion yuan to 30 trillion yuan by 2035. By 2050, elderly consumption is expected to reach 40 to 69 trillion yuan — accounting for up to 20.7 percent of the country's GDP.

Greater Bay Area, Greater future

Next on industry and company news

Switching gears to financial news

Wrapping up with a quick look at the stock market

Executive Editor: Sonia YU

Editor: LI Yanxia

Host: Stephanie LI

Writer: Stephanie LI

Sound Editor: Stephanie LI

Graphic Designer: ZHENG Wenjing, LIAO Yuanni

Produced by 21st Century Business Herald Dept. of Overseas News.

Presented by SFC

声明:本网转发此文,旨在为读者提供更多资讯信息,所渉内容不构成投资、建议消费。文章内容如有疑问,请与有关方核实,文章观点非本网站观点,仅供读者参考。

养老投资基金为什么是FOF

养老投资基金为什么是FOF

岁月匆匆。在人生长河中,我们常常被时间裹挟着奔跑,往往忽略了对未...

《数字中国发展报告2022年》发布我国数字经济规

《数字中国发展报告2022年》发布我国数字经济规

国家互联网信息办公室日前发布的《数字中国发展报告》(以下称《报告...

发布“352”服务蓝图中国太保升级大健康战略

发布“352”服务蓝图中国太保升级大健康战略

竞逐大健康市场,不少机构已经提前布局抢占赛道,打造未来发展第二曲...

iPhone16Pro系列确认6.3/6.9英寸

iPhone16Pro系列确认6.3/6.9英寸

,此前已经有多方传闻称,iPhone16Pro系列的屏幕将会加大...

中国汽车T10-ICV-CTO研讨会以下简称“C

中国汽车T10-ICV-CTO研讨会以下简称“C

中国网middot;美丽苏州讯5月27日,中国汽车T10-ICV...

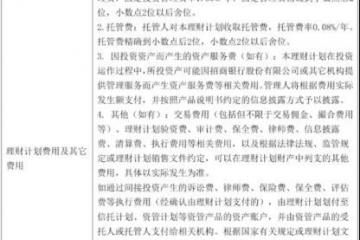

震动金融圈!首只银行理财产品不赚钱不收管理费

震动金融圈!首只银行理财产品不赚钱不收管理费

招银理财发行的一只类公募基金引发了市场的强烈关注。该产品为招卓价...